* WHERE WE DECLARE WHAT ON THE PLATFORM: *Clicking on the category “Electrified” registers square footage corrections for all electrified buildings that were declared with insufficient square footage.

*By clicking on the category “Non-electrified” the corrections for:

- Building surfaces with “cut” power supply due to interruption (not due to debt)

- Building surfaces that never declared for submission to municipal taxation

- Surfaces of buildings, completed or unfinished, which never electrified

- Surfaces plots that have not been declared to the Municipality for imposition of TAP.

*DECLARATION OF PLOTS FOR PAYMENT OF TAP . POMIDA reminds in particular the owners of plots within the plan and within the settlement, and the owners of buildings outside the plan anywhere throughout the country, that failure to submit a TAP declaration entails a fine of twice the due fee corresponding to the property! That is why he recommends that they register them on the platform with their correct areas, even if they had once declared them, so that on the one hand all their debts are erased by 31.12.2019, and on the other hand the Municipalities can send them annual payment notices from now on of TAP without the double fine.

* RESULT OF THE STATEMENT OF CORRECTION ON THE PLATFORM. The correction statement does not automatically change the area of the property in the DEDDIE file. The statement will be processed and the declared areas adjusted with any reduction factors, by the Revenue Service of the competent Municipality, which in case of serious doubt may request documentation of the details of the statement.

See President POMIDA’s clarifications on the platform on the MEGA show weekend of 7.3.2020

Click on the image below to be automatically taken to

LEGAL FRAMEWORK OF THE REGULATION IMPLEMENTED WITH THE OPERATION OF THE PLATFORM

Real modern “Seisachtheia” is for hundreds of thousands of property owners throughout the country with wrongly declared areas in the Municipalities, the provision of article 51 para 2 of Law 4647/2019 (Government Gazette 204/A) which was enacted on the initiative of the Minister of the Interior Mr. Panagiotis Theodorikakos and the President of KEDE Mr. Dimitris Papastergiou. The provision, which was a proposal and persistent request of POMIDA for many years, exempts the owners from fines and retroactive and in addition brings an immediate and significant increase in the annual revenues of the OTAs, defines the following:

“Those liable to submit a declaration for the determination of the area or the use of a property regarding the calculation of taxes, fees and contributions to the OTAs of the first degree can submit a declaration with the correct data until 31-3-2020, without the imposition of fines for not submitting or submitting an inaccurate declaration. Differences in the corresponding taxes, fees and contributions from the declarations of the previous paragraph are calculated and due only from 1.1.2020”.

Then, with article 21 of the Ministry of Internal Affairs bill which was already passed by the Parliament on 5.3.2020 and is headed for publication in the Official Gazette, defines the following in particular:

1.The deadline for submitting non-electrical property declarations is extended until 30.6.2020.

- The already certified debts of municipal fees and TAP from area differences are deleted, not until 31.12.2019 but until the day of submitting their voluntary declaration to the relevant Municipality.

- However, only the amounts confirmed after an audit by the Municipality service are excluded from the deletion. The amounts confirmed due to a request for a certificate for the transfer of property are also deleted!

- The amounts already paidto the Municipalities for the above reasons are not returned.

- The deadline for declarationof undeclared areas is extended until 30.6.2020only for those owners who carry out arbitrary regulation after 31.3.2020.

The voted text of this regulation is as follows:

Regulations for the imposition of municipal fees on real estate

- Paragraph 2 of article 222 of Law 4555/2018 ( A’ 133) is replaced as follows: “2. Debts from cleaning and lighting fees for a property, whose electricity supply has been interrupted, according to a certificate from the competent network operator and which, according to a responsible statement of the owner or his legal representative, was not used during the reference period, are deleted or omitted their confirmation. The responsible declaration of the previous paragraph can be submitted until 30.6.2020. Amounts that have been paid are not sought.”

- Paragraph 3 is added to Article 51 of Law 4647/2019 (A΄ 204), as follows: “3. Certified debts from taxes and fees to the OTAs of the first degree, which correspond to differences in terms of the surface of a property or its use and concern a period of time prior to the submission of the declaration, as well as the related fines, are deleted. Amounts already paid are not sought. The regulation of the first paragraph does not apply to the cases where the debts have arisen after an audit of the service. . 4495/2017, the provisions of article 51 of Law 4647/2019 (Α΄ 204) apply until 30.6.2020.

The platform operates at https://tetragonika.govapp.gr/

QUESTIONS

Property owners who have questions about the platform and how to correct the areas of their properties they must:

*Read carefully the relevant instructions and clarifications written therein, which are constantly enriched,

*Apply to the Revenue Service of the relevant Municipality,

*Apply to the tax professional who submits the tax returns the statements,

*To address POMIDA exclusively through the special form asking questions of the MEMBERS PAGE of, and with their passwords, since there is no practical way to answer in the hundreds of e-mails with third-party inquiries that are sent to us in the rain…

THE SUCCESS OF THE PLATFORM: 740,000 citizens in 5 days for the undeclared square meters!

1,585,717 square meters in addition to the Municipalities of the country!

“The huge response to an interoperability that does not require any documentation and is done in four clicks proves the trust of citizens in an online service that is easy to use, understandable and secure”, said the Minister of State and Digital Governance Kyriakos Pierrakakis to the news that hundreds of thousands of citizens have used the new electronic platform since its first days of operation to submit requests to correct the declared square footage for those properties that were incorrectly declared to the municipalities in the past.

According to ministry sources, the response exceeded all expectations, since within five days of the service’s operation, 739,866 citizens visited the online platform https://tetragonika.govapp.gr/.

The request was to initially compare the square meters of their properties, which they have declared in E9 with the declared square meters they have submitted to the relevant Municipality.

Of these, 59,600 submitted applications with corrective statements and it is typical that among them are 1,230 foreign residents. Of the 59,600 declarations, 50,414 concern electrified properties and 9,187 non-electrified properties. Municipalities of the country. This is a percentage of 36.48% in relation to the square meters they had declared in E9 and those they had submitted to their Municipality, in order to calculate the municipal fees.

The platform opened at exactly 14:00 on February 27 and immediately started getting a lot of traffic, the same sources say.

Since then, it has been running smoothly, serving with minimal effort. It is typical that the check and declaration is done with four clicks, without any supporting documents and with an average submission time of 5 minutes and 14 seconds.

The Ministry of Digital Governance, the The Ministry of the Interior and KEDE developed the platform in order for owners to benefit from the beneficial provision of Article 51 of Law 4647/2019 (proposed and succeeded by POMIDA) which stipulates that owners are exempt from retroactive charges if they submit the declaration of correction of square footage.

It is reminded that until 31/3/2020 a corrective declaration is submitted without fines for not submitting or submitting a previous inaccurate declaration.

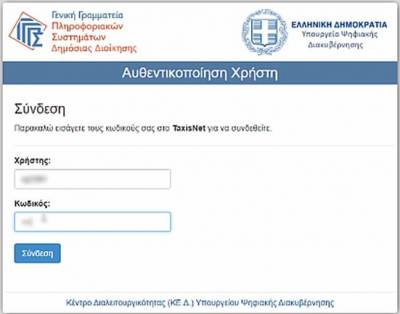

In order to submit the corrective statement, only the identification with the codes used to enter Taxis is required.

The application is mobile friendly provides accessibility to everyone and has an electronic manual for both citizens and municipal services. It is suitable for the disabled and fully harmonized with the WCAG 2.0 standard.

NEED TO UPDATE ALL OWNERS ME EMAILS OF AADE!

POMIDA emphasizes that it is absolutely necessary to inform the last owner of the country and the diaspora Hellenism of this arrangement, and will not get tired of repeating that a necessary condition for the massive its participation and success is the immediate sending of informative emails from the AADE to all real estate owners – TIN holders of our country and their tax experts, for this setting and the statement platform!

POMIDA’S STATEMENT GUIDELINES ON THE PLATFORM

POMIDA INVITES all property owners in the country, namely those who have long declared the area of their properties to the Municipalities, those who have recently settled arbitrarily, but also those who have undeclared area for any reason, hurry to check through the electricity bills the declared area of their properties and make timely any required corrective declarations, in order to benefit from this unique regulation, the extensive application of which will give the Municipalities the possibility to reduce the municipal fees for all citizens. He also calls on the owners of vacant and non-electrical properties, as well as those that have never been electrified, to declare them to the relevant Municipalities, so that municipal fees are not charged both for the past and for the future.

For the information of its members and every interested property owner, POMIDA lists a Decalogue with the basic questions and answers to the above topics:

- Who is a beneficiary in this arrangement?

Each owner of a building or plot within a plan and within a settlement that has not declared it to the relevant OTA as every owner who has declared it with a smaller area than the real one, such as apartments, single-family houses, shops, offices, warehouses, auxiliary areas of buildings and apartment buildings, craft and industrial and uncovered areas, legally or arranged arbitrarily, but also buildings outside the real estate plan, electrified or not.

- Which real estate surfaces are subject to this regulation?

This regulation expressly covers indicatively the surfaces of properties that were incompletely declared, surfaces of properties that were never declared for submission to municipal taxation and also surfaces of properties that were never electrified.

- What is he entitled to do and why?

To submit a statement with full and correct details of the surfaces of all his properties, electrified and not, with which he will be freed from all retroactive debts of many years and from any fine or surcharge, as provided by the relevant legislation, especially for the settlements of arbitrary properties.

- From which categories of taxes and fees does this regulation retroactively exempt?

The this regulation covers all kinds of taxes, fees and contributions to the Municipalities of the country, i.e. the municipal cleaning and lighting fees, the Property Tax (TAP) and the municipal tax.

- Where and how should these declarations be submitted?

The declarations will be submitted electronically to the new online platform of KEDE, through which each interested owner will be able to correct any error he finds, responsibly declaring the actual current area of each of his properties, electrified or not. Any change of use, as well as a reduction in the area of the property, can only be reported to the Revenue Service of the respective Municipality, as long as these are documented on the basis of their title deeds and E9. These declarations will be forwarded to the Revenue Service of the relevant Municipality for processing and calculation of any amount due TAP or municipal fees, the result of which will be informed to the owner concerned.

- Until when must these declarations be submitted?

The deadline set by this provision is until March 31, 2020.

- From when will the charge for the additional areas to be declared start?

The charging of municipal taxes and fees of the additional areas will start from 1.1.2020, whenever these are declared. The already confirmed debts of municipal fees and TAP from area differences, are not deleted until 31.12.2019 but until the (earlier) day of submitting their voluntary declaration to the relevant Municipality.

- What will happen if the additional areas are not declared on time?

After end of the voluntary declaration deadline, the previous provisions that provided for retroactive debts with fines will come into force again, which will be activated either when the cross-checking of the DEDDIE data with the E9 data, to which the local authorities of the country now have access, begins, or when the interested owner or his heirs request a certificate of non-debt TAP for transfer, parental provision or acceptance of inheritance of the property.

- What will happen to those who submitted declarations before the publication of the above law, and the relevant amounts of municipal fees were confirmed against them?

Debts from differences in declared real estate surfaces, verified with the voluntary attendance of the interested parties, are written off unless they arose and were verified after an audit by the Municipality’s Revenue Service. Amounts paid due to an application for the issuance of a property transfer certificate are finally deleted as well! However, amounts paid are not returned.

- What about declarations for vacant and non-electric properties?

The relevant deadline for submitting declarations for vacant and non-electrified properties, which expired on December 31, 2019, has been legislatively extended to June 30, 2020.

KEDE’S INSTRUCTIONS FOR CONNECTING TO THE PLATFORM

Go to https://tetragonika.govapp.gr/ properties”

We will be asked to connect to TaxisNet details

Creating New Declaration

Once a successful connection to the app we go to our statements page and select “Create New Declaration”

To create a new statement we must authorize the application to go ahead with our property in the AADE Property. //wiki.govhub.gr/lib/exe/fetch.php?w=300&?tok=F4A898&?media=politis04.jpg ” Make your property statement, you should draw your attention to the following:

- Each statement is made per no. Providing for your electrified properties or per property in case it is not electrified. Provision will automatically be added to your declaration and whatever real estate you have to the municipality with the same supply number.

- If you wish to add property without no. Provide to your statement, click the “Enter the Statement” button ΄. The property will be considered to be electrified and will have the same no. Providing with the remaining properties of the statement. Align: Justify; “>

Then we select the municipality that is addressed by our statement

Click “Introduction to the Statement” to introduce the property * in our statement * If our property has not appeared, we create a property from the corresponding button

At this point the application displays in our statement three (3) fields

The property as it appears in E9

- Our statement

- The property as it appears in DEDDIE along with the difference of square meters from E9. Style = “Text-align: Justify;”>

At this point we fill in the real sq.m. In our statement to the Citizen’s statement in the field field

If we complete our statement we must enter our contact details to be able to informed by email (Mandatory) When our statement is completed by the municipality employee, and a contact phone (mobile or fixed – compulsory to complete one of the 2 phone numbers) in case the employee wants to contact us.

by pressing “temporary storage”, our statement is not submitted, but is temporarily stored and we can see a preview of the information we stated. If we want to edit it, we press the “Edit” button and we modify whatever field we want (at this stage, if we return to our statements, we will see how a temporarily stored statement has been created, which we can again modify with the processing button. located in the last column right)

In the statement history, we see the whole history of our statement, including its listing and every amendment that We did. “Text-align: Justify;”>

enter the electronic platform Municipal Declaration of the Municipality of Athens

See the clarifications of POMIDA President on the MEGA Weekend show on 7.3.2020

<p style =" Text-Align: Justif See the relevant <a href = "https://www.megatv.com/koinoniaoramega/default.asp?catid=43375&?subid=2& ;pubid=38546356" The premiere of the MEGA TIME SOCIETY TIME