- ENFIA or ENFIA?It is a significant development that for the first time from the lips of the Prime Minister there is a special reference to intervention in the supplementary tax of ENFIA, which is the most obvious distortion of our tax system. The recent significant increase in property values in most regions of the country requires drastic interventions in ENFIA, firstly the complete abolition of the additional tax, and not its perpetuation in any indirect way, and especially with the accumulation and punitive taxation of assets that most it is unprofitable. The commitment that “most households will pay (in 2022) a lower ENFIA than in 2021” does not reassure those who have “bleed” paying the most, and does not reconcile with the doctrine of “we will leave no one behind”. We therefore await the specification of the new arrangements that will finally lead from the double and unfair ENFIA to the single and fair ENFIA!

- PARENTAL BENEFITS.The announcement of an increase in tax-free parental benefits to 800,000 euros is a historic gesture towards the Greek family, but it remains to be seen how it will be specified by the staff of the Ministry of Finance. The questions that must be answered are the following:

-This tax-free limit will concern parental benefits from each parent to each child, as it currently applies for the tax-free amount of 150,000 euros, or will it be family?

-If it is family, it will be distributed in an amount of up to 400,000 euros from each parent to each child, or will it apply even if only one parent transfers real estate worth 800,000 euros?

-Will this tax-free be limited only to the children, or will it also concern the grandchildren, who are also the valid one, but also the right one?

-Will this tax-free only apply to parental benefits, or will it also concern the inheritance tax, which is the valid one but also the correct one?

-Will the tax-free also cover cash or other countable assets?

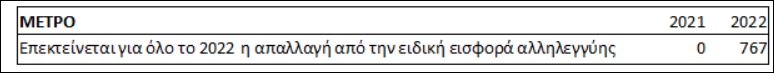

- “SOLIDARITY” CONTRIBUTION. A positive measure is the extension for the whole of 2022 of the exemption from the special solidarity levy of 2.20-10% on income and on real estate. What was missing was the absolutely necessary reduction in the rates of the predatory, literally, rental tax scale, which remains as it was from the previous government, even as the corporate tax rate is reduced to 22%, or 15.4% in case of their merger!

- CHAPIT AGREEMENT TAXMERGING COMPANIES. A particularly positive incentive is the reduction of the capital accumulation tax of the merging companies from 1% to 0.5% on the value of their properties.

- DISCOUNT OF ELIGIBLE BUSINESS EXPENSESby 100% which is doubled in case of energy upgrading of their properties, innovation and extroversion.

Our opinion is that the validity of the last two important measures, and the reduction of rental taxation rates should be immediately extended to natural persons, in order to eliminate this chaotic inequality of tax treatment between natural persons and legal entities.

The measures in detail.

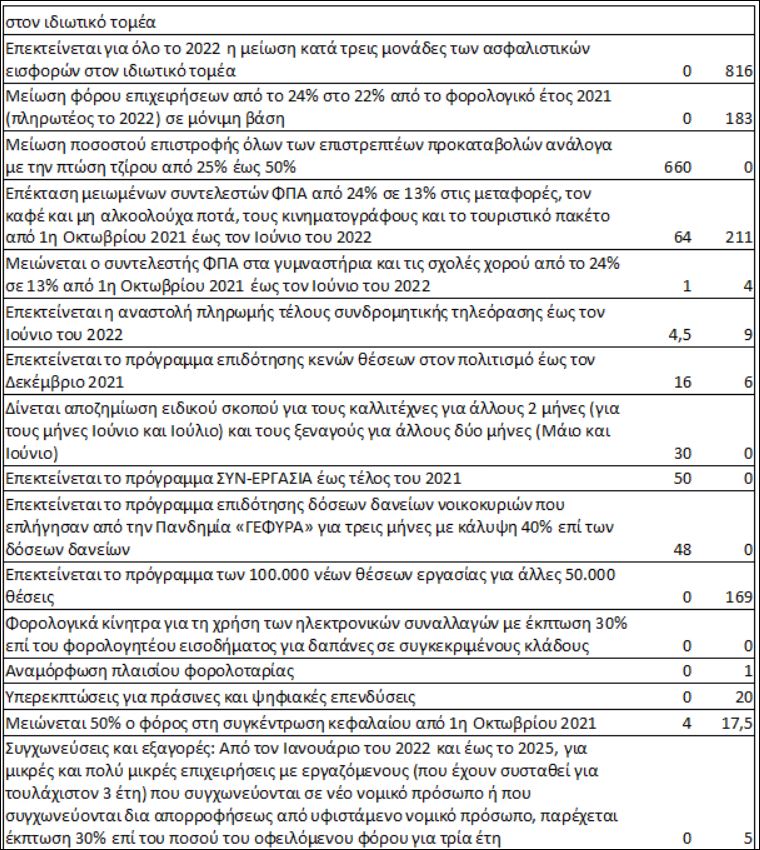

- Extended for the whole of 2022 the exemption from the special solidarity levy and the reduction of three units of insurance contributions in the private sector. Cost 1.58 billion for 2021 and 1.58 billion for 2022.

- From January 2022 the corporate tax is reduced from 24% to 22%. Cost €183 million for 2022.

- The rate of return of all refundable advances is reduced in proportion to the decline in the business’s gross revenue. More specifically, as long as the employee retention clause stipulated in each refundable cycle has been met, it is refunded:

For businesses that have started operations before January 1 2019 and have positive gross revenue in 2019:

One quarter (25%) is returned if they have a gross revenue drop in 2020 compared to 2019 of more than 70% and record pre-tax losses.

The third (33.3%) is returned if they have a drop in gross revenue in 2020 compared to 2019 between 30% and 70 % and record pre-tax losses.

For other businesses, 50% is returned.

For new businesses that have started operations after January 1, 2019 or had zero gross revenue in 2019:

One quarter (25%) is returned if they have a fall in gross revenue in 2020 compared to 2019 (provided they recorded positive gross revenue in 2019) of more than 30% and record pre-tax losses.

For other businesses it is returned the third (33.3%).

Based on the above figure it is calculated that:

-28% of businesses will return a quarter (25%),

-39% of businesses will return a third (33.3 %),

-33% will return 50%.

It is recalled that until today 50% to 100% was returned to returnees 1 to 3 depending on the drop in turnover, while for all businesses returnees 4 to 7 were returned 50%.

In addition to the above, a 15% discount applies in case of a one-time payment of the amount to be refunded by December 31, 2021. Otherwise, the amount is paid in 60 installments from January 2022.

Fiscal cost incurred in 2021: 660 million euros.

- Extending the application of reduced VAT rates to transport, coffee and non-alcoholic beverages, cinemas and package tours until June 2022. Fiscal cost for Oct-Dec. 2021: 64 million euros. Fiscal cost for 2022: 211 million euros.

- The VAT rate for gyms and dance schools is reduced from 24% to 13% from October 1, 2021 to June 2022. Fiscal cost for Oct.- Dec. 2021: 1 million euros. Fiscal cost for 2022: 4 million euros.

- The suspension of paying the subscription TV fee is extended from October 2021 to June 2022. Fiscal cost for Oct.-Dec. 2021: 4.5 million euros. Fiscal cost for 2022: EUR 9 million.

- Extends the cultural vacancy subsidy program until December 2021. Fiscal cost for 2021: EUR 16 million. Budgetary cost for 2022: 6 million euros.

- Special purpose compensation is given for an additional two months for artists (for the months of June and July) and guides (for the months of May and June). Fiscal cost for 2021: 30 million euros.

- The CO-WORK program is extended until the end of 2021. Fiscal cost for 2021: 50 million euros.

- The loan installment subsidy program for households affected by the “GEFYRA” Pandemic for three months with 40% coverage on loan installments. Cost 48 million euros for 2021.

- The 100,000 new jobs program is being extended for another 50,000 jobs. Cost: 169 million in the 2022 budget.

- Tax incentives for the use of electronic transactions: From January 2022 until 2025, 30% of expenses made with electronic means of payment to certain professional branches and up to the amount of 5,000 euros per year, are deducted from the taxable income of natural persons.

Indicative Branches: Plumbing, electrician, oil painting domestic services, cleaning services, childcare services, services to help people at home, gyms, dance schools, taxis, legal services. In addition, expenses for medical, dental and veterinary services count double towards the minimum 30% spending limit with electronic means of payment.

- The framework of the tax lottery is reformed: Today in each tax lottery 1,000 lucky winners win 1,000 euros each, at a cost of 12 million euros per year. What is proposed: A different weighting will be given depending on the percentage of income consumed.

Citizens with a lower family income and with more children will have an increase in number of lottery tickets and the probability of winning. Each month’s lottery prizes will escalate and reach up to €50,000. In addition, at Christmas there will be a special lottery with prizes of up to 100,000 euros.

- Granting an additional deduction for green economy, energy and digitization expenses: From 1 January 2022 and for three years, selected green economy, energy and digitization expenses are deducted from gross income of small and medium enterprises at the time of their implementation, increased by a percentage of up to one hundred percent (100%).

- Incentives for mergers and acquisitions: From October 1, 2021, the tax on capital accumulation is reduced by 50%. Fiscal cost of 18 million euros per year. Sole proprietorships may, through partnerships, create a new legal entity of a higher form, so that they are subject to the taxation of legal entities on favorable terms.

For businesses -legal entities that merge into a new legal entity or that are merged through absorption by an existing legal entity, creating significant economies of scale, will be granted a 30% discount on the amount of tax due for three years.

Lending: Acquisitions and mergers are one of the five eligibility criteria for access to the Recovery Fund’s €12.7 billion loans, with a very low interest rate .

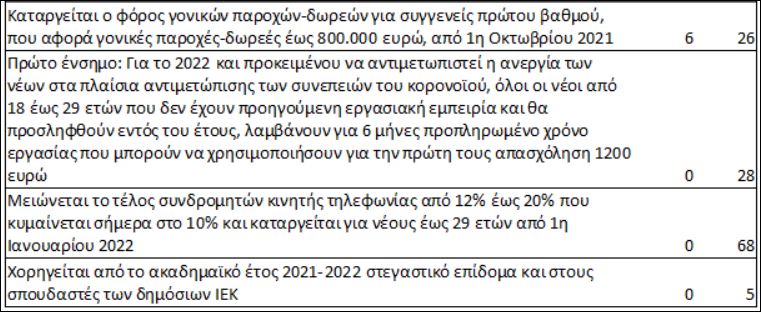

- The tax on parental benefits-donations for first-degree relatives is abolished, which concerns parental benefits-donations up to 800,000 euros, from October 1, 2021. Cost 26 million per year.

- First official: For 2022 and in order to tackle youth unemployment in the context of dealing with the consequences of the corona virus, all young people aged 18 to 29 who have no previous work experience and will be hired within the year receive 6 months of pre-paid working time which they can use for their first job. The aid amounts to 1200 euros for the first 6 months of full-time employment. Of this amount, half will be received by the employee (in addition to his salary) as an incentive to find a job and the rest by the employer as a wage cost subsidy. For part-time work corresponding to at least 50% of full-time work, half the amount will be given. Fiscal cost of 28 million euros for 2021 and 14 million euros for 2022.

- The mobile telephony subscriber fee is reduced from 12% to 20%, which is currently 10% and is abolished for young people up to 29 years old from January 1, 2022. Fiscal cost: 68 million euros per year.

- From the academic year 2021-2022, the grant of housing allowance will be extended to students of public IEK (it is estimated that approximately 5,000 of the 20,000 students of public IEK will live in another city and meet the income/property criteria to become beneficiaries). Fiscal cost for 2022: 5 million euros.

- After the adjustment of the objective values, we proceed to reduce the ENFIA calculation factors that will apply for 2022. The results of this ongoing exercise will be available until the end of the year. The objective of the exercise is the fairer distribution of the tax while reducing the ENFIA for the majority of citizens from the new year.

- For the 4th quarter of 2021 (October to December) the entire population is subsidized first 300 Kwh with an amount of €30/Mwh, compensating almost all of the expected current increase. It is noted that the average consumption for a typical household ranges from 300-400 Kwh per month. The above subsidy also applies to low voltage professional tariffs. The cost for the quarter amounts to €150 million and will be subsidized by the redistribution of emissions trading system revenues.

- From October 1, 2021, the VAT on feed intended for animal production will be permanently reduced from 13% to 6%. Fiscal cost: 15 million euros per year.

- Heating allowance. The aid amount for the heating allowance to be given in December 2021 is increased by 20%. Fiscal cost for 2021: EUR 15 million.

- Innovative program of the Ministry of Health for the general population is planned, with resources of the recovery fund of EUR 120 million, to carry out free cervical cancer screenings , Breast cancer, Colon cancer and diagnostic tests for cardiovascular risk.

TABLES OF MEASURES

Benefit from reduction of insurance contributions and solidarity contribution:

-An employee with a gross salary of 1,000 euros (847 net) has an annual benefit of 132 euros from the reduction insurance contributions.

-An employee with a gross salary of 1,200 euros (1,016 net) has an annual benefit of 207 euros (158 euros from the reduction of insurance contributions and 49 euros from the solidarity contribution.

-An employee with a gross salary of 2,000 euros (1693 net) has an annual benefit of 604 euros (243 euros from the reduction of insurance contributions and 461 euros from the solidarity contribution.

Additional benefits for youth:

-If youth up to 29 years with a monthly mobile bill of 50 euros will have an additional annual benefit of 90 euros.

-If he works for the first time he will receive 600 euros in addition to his salary from the state.

-If he studies at a public IEK in another city, he will receive an additional 1,000 euros per year housing allowance.

-Now he can parent to make a parental benefit of property or money to their child without any tax.

Business benefits:

-From maintaining the reduction of insurance contributions by three units, they have an annual benefit of 251 euros for each employee who receives a gross salary of 1,000 euros.

– Income tax is reduced from 24% to 22%.

-The VAT reduction is maintained in a number of sectors and extended to others.

-If he hires an employee through the 100,000 jobs program he will not pay insurance contributions for six months and if he hires a long-term unemployed person he will receive a 200 euro per month wage subsidy. In addition, if he hires a new person without previous work experience, he will receive 600 euros.

-The capital accumulation tax is reduced by 50%.

-In the case of a merger, it is reduced the income tax by 30% for three years.